It’s hard to believe a whole year has passed since we announced our G2 2021 Software Buyer Behavior Report findings at the SaaStr Annual conference. But, here we are again, as I find myself back in the San Francisco Bay area, readying to take the stage to present our 2022 report findings.

While many of the findings then still stand true today (like buyers taking greater control over their purchasing journey), there are many trends that have accelerated and new insights gleaned. We also expanded our respondent pool this year, surveying over 1,000+ global B2B buyers.

While there are many, these are the top three trends that stood out to me:

- Buyers are increasingly wary of bias, seeking sources they can trust.

Who influences buying decisions is changing, as software company websites are declining in trust. They’re still often sourced and cited, but not as frequently as they were even a year ago. Compared to 2021, a vendor’s website and its sales teams’ importance declined by 5 and 4 percentage points, respectively, while reviews websites gained 5 points. At the same time, a lack of credible content and references hinders decisions – with 60% of buyers citing lack of credible content, customer references, or reviews as their top obstacle to making purchase decisions.

This increasing need for trusted sources is seen again when according to our 2022 survey, the most influential sources in buyer’s purchasing decisions are: 1) industry experts; 2) professional colleagues / network; 3) internal influencers; 4) online reviews from peers. Further validating the shift away from biased sources, these rank above other sources like vendor supplied content and sales.

- Third-party buying is on the rise with the need for faster, more frictionless purchase journeys.

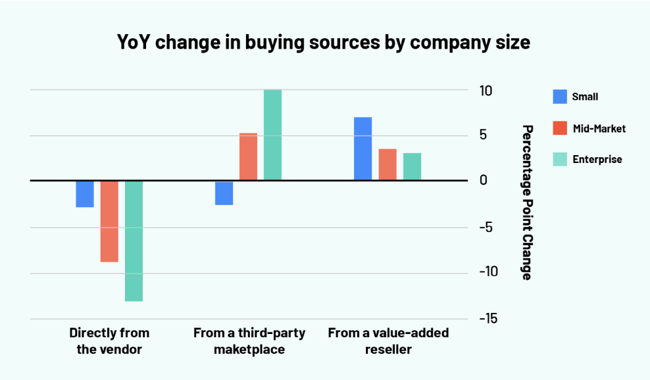

We know the vendor role is changing in terms of being trusted less as a top research source. But it’s also changing in terms of being the channel in which buyers purchase from. Our survey findings this year show that while 60% of respondents still prefer to buy directly from the vendor, this was a 9 percentage point (pp) drop over 2021, while those who prefer to purchase via third-party marketplaces (up 6pp to 28%) and value-added resellers (up 4pp to 11%) both increased.

The acceleration of these buying preferences come as the majority of respondents across all company sizes (more than 80%) said they need less than six months to make a purchase decision of $20,000 or more. In addition to speeding up the purchasing journey, there are other reasons software buyers may seek out other channels. Marketplaces can offer that convenience and comfortability some are seeking, while VARs provide the consultative support others need to ensure a successful implementation post-purchase.

- How easily software is implemented and used drives purchasing decisions.

When we asked software buyers what the most important considerations are when they’re making a software purchase, they ranked the following as their top three: 1) ease of implementation; 2) seeing ROI in six months; 3) ease of use. It’s important to note that all of these considerations increased in importance year-over-year, and ranked well above the software solution’s price point, which fell near the bottom of the list.

At the end of the day, companies need software to be successful to help them reach their goals. We see this even despite economic uncertainty, where most buyers expect their software and tech spending to either increase or remain the same in 2022 (89%) and 2023 (92%). But they’re under greater pressure to prove value faster. This is why we also see that 93% of buyers indicate that the quality of the implementation process is important or very important when making the decision to renew a software product. And, more than half (57%) of all software contracts are six months or less.

Ultimately, software buyers need the purchase process to be easy, the implementation to go smoothly, the software to be easy to use and quickly adopted, and they need to see results as soon as possible. Making things easy is the name of the game!

All of these findings point to an exciting opportunity for software companies — but only if they take swift action to meet buyer needs. Here are a few things they can do now:

- Proactively engage buyers earlier in the process. Also keep in mind that buyer interactions should include multiple points of engagement, including sales reps, but primarily focused on self-serve sources of peer feedback and product information.

- Ensure the product is represented across all potential purchase points, particularly within marketplaces. Be where your buyers are, including where they’re conducting their own research.

- Eliminate friction in the journey, especially during the implementation process, focusing on the customer experience and offering additional trainings. The challenge to product and marketing teams right now is: how can you make it easier for the buyer to both buy AND use your product?

You can read additional findings by downloading the G2 2022 Software Buyer Behavior Report and checking out our press release.

See you back here next year…same place, same time. I’m giddy just thinking about what we might see in the 2023 report! Until then, we’ll be continuing to learn about all of the 60M+ annual buyers visiting the G2 marketplace. And, stay tuned for the results of our annual Best Software Awards in February, which will be here before we know it!

by Amanda Malko

by Amanda Malko

by Amanda Malko

by Amanda Malko

by Amanda Malko

by Amanda Malko