When it comes to G2 data, the possibilities are endless. With G2 Data Solutions, investors can tap into our data to make more informed decisions about potential investments in the software industry.

By providing unbiased user reviews, competitive analysis, insights into product-market fit, and other market trends, G2 empowers investors to make data-driven decisions and uncover opportunities for growth and success.

With over 2,000 categories on G2, investors can identify category leaders, map software categories, track adoption rates, forecast demand, and reduce risk.

Exploring a category poised for growth: Analytics Platforms

Considering recent growth and anticipated momentum of the Analytics Platforms, our team recently conducted an analysis of this category as one investors should have on their watch lists. In our analysis, we explored top vendors in this segment, including a deep dive into one vendor in particular that caught our eye: Sigma Computing.

For background, analytics platforms enable customers to absorb, organize, discover, and analyze data to reveal actionable insights that can help improve decision making and inform business strategy.

To be classified as an analytics platform on G2, a product must exhibit the following five main elements.

- Data preparation: An analytics platform at its core must enable users to discover, blend, cleanse, and enrich data so that large datasets can be easily integrated, consumed, and analyzed.

- Data management: Once integrated, data stored within these platforms must be maintained, including the ability to restrict data access for certain users.

- Data modeling and blending: These platforms enable users to consolidate data and combine data points to understand relationships and derive deep insights.

- Data visualization: Reports, dashboards, and visualizations can break down data, depict connections and trends between datasets, and help create charts and graphs that make data easier to understand.

- Insights delivery: Users can display metrics of their choice through multi-layered, real-time dashboards.

The evolution of the Analytics Platforms space

The Analytics Platform category has seen substantial growth within the last few years. What’s fueling this momentum? Let’s dive in.

After 2019, when Salesforce and Google acquired Tableau and Looker, respectively, the amount of capital deployed to fund vendors within this category grew rapidly. Then, during the pandemic, category traffic on G2 — indicating buyer interest in these solutions — saw a surge, increasing 12% and 27% year over year in 2020 and 2021, respectively.

This category, like many others, benefited from a wave of digitization that took place during the pandemic. It’s also poised to rebound after the broader SaaS market contraction in late 2022 and 2023. Despite the economic uncertainty and high interest-rate environment, software buyers will likely continue to turn to analytic platforms to centralize and analyze their data.

Beyond the rise in traffic to the Analytics Platform category, we also observed a 35% per year spike in the number of products reviewed from 2020 to 2023. Additionally, we also observed a 16% per year increase in the total number of reviews for products that compete within this category over the same time period.

This increase in the number of products reviewed outpaced many other categories on G2, including the CRM category, which saw a 25% increase per year in products reviewed during the same time period. Additionally, page traffic for this category outperformed its broader parent category (Analytics Tools & Software) in 2023.

We do not expect this growth to slow down. In fact, this category is likely to continue to grow over the next few years, as additional companies turn to analytics solutions to manage the proliferation of data sources while harnessing the power of cloud computing and AI. We believe this is an interesting category to keep an eye on going forward, with funding appearing to increase in YTD July 2024, according to PitchBook.

Understanding the competitive landscape

G2’s proprietary taxonomy allows investors to group like-vendors and products together to make more apples-to-apples comparisons for any category. This makes it easy for our customers to make the right comparisons when understanding which vendor has the clear right to win and competitive advantage.

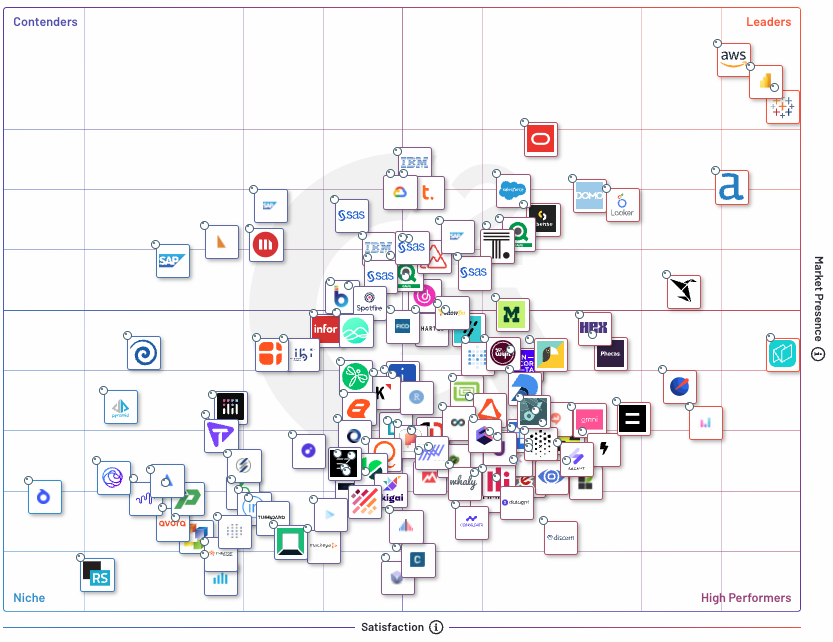

Each quarter, G2 releases Grid® Reports for individual categories so investors can track vendor performance on the Grid® over time. When it comes to the most recent Grid® Report for the Analytics Platforms category, we found three distinct vendor archetypes within our data:

- Cloud Powerhouse Platforms: Full suite analytic platforms that, with the exception of Alteryx, these players are typically owned by large cloud providers.

- Up and Coming Challengers: Smaller niche platforms with either a unique product interface or specialization to serve a particular industry segment.

- Legacy Power Platforms: Analytic platforms that have been around for many decades and offer a wide breadth of capabilities, but lag behind in product development.

In the 2024 G2 Buyer Behavior Report, G2’s survey of more than 1,900 software buyers found that the Data Analytics category has the highest level of importance for AI functionality. For those players that stay behind in implementing AI functionality within their analytics platform, these vendors are likely to be overtaken by their competitors.

Why Sigma, a niche player, stands out in this category

On G2, software buyers complete surveys that translate to 48 different data points across over 180,000 products and services and more than 150,000 software vendors globally. This unique dataset is available to G2 Data Solutions customers, enabling investment teams to understand user sentiment, observe buyer-behavior patterns, and peruse switch-to-from analyses before launching a customized survey or getting on the phone with expert networks.

As we reviewed our proprietary dataset to assess vendor momentum for the Analytics Platform category, Sigma, a smaller niche player within the category, stands out. The company gained significant momentum over the past four years — its share of category traffic increased from 0.3% in 2019 to ~2% in YTD August 2024. It also appears that this smaller vendor is potentially taking share from some of the larger players within this category.

Additionally, Sigma’s NPS has grown stronger over the past four years, particularly within the Enterprise segment:

- The number of enterprise reviewers as a percentage of total increased from ~11% in 2020 to ~17% in YTD August 2024.

- The average NPS of enterprise reviewers has improved drastically over this time period, from 39 in 2021 to 83 in YTD August 2024.

- In September 2023, Sigma announced that for two consecutive quarters, the company has doubled its revenue and is growing its list of enterprise customers.

- In February 2024, Sigma announced its annual recurring revenue growth was over 100% for four years straight, with a 134% increase in net new logos.

And according to reviews left on G2.com, customers are praising Sigma’s ease of use and user-friendly interface.

Where you go for the truth on the future of software

Based on our analysis, we’re expecting to see analytics platforms' interest and investment to rise in the years ahead. But it’s not the only software space seeing momentum.

G2’s proprietary Momentum Score identifies categories that are on a high-growth trajectory based on year-over-year growth in user satisfaction scores, employee growth, and digital presence.

According to our latest State of Software Report, the parent category Analytics Tools & Software has ranked fifth over the past year in terms of G2 Momentum Score, just behind AI, Governance, Risk & Compliance, Data Privacy, and Security.

The race for winning investment dollars and software buyers’ budgets is on. We’ll be continuing to monitor what’s happening in real time. When you combine data from verified G2 reviews, buyer traffic and intent, and the taxonomy, you have a real pulse on what’s happening in the market today and what's forecasted for tomorrow. That’s the power of G2 Data Solutions.

If you’re a SaaS investor and want to learn more about how Data Solutions can help with your investment process, reach out to our team!

by Noor Hamouda

by Noor Hamouda

by Noor Hamouda

by Noor Hamouda

by Noor Hamouda

by Noor Hamouda