Current economic challenges might indicate a pullback in software spending – but think again. Businesses are still increasing software spend. What’s behind this increase? What challenges do vendors face? What does this value-driven buyer look like? What should you do about it? The answers, uncovered in G2’s 2023 Software Buyer Behavior Report, may surprise you.

Published today, the annual report reveals the latest software buying insights and trends based on a survey of 1,700+ global B2B software decision-makers. Several trends observed in prior reports held strong in 2023, such as the changing role of software vendors as buyers continue to seek self-serve channels and sources they trust. And while there are more than a few new insights in this year’s report, I’d like to take the time to take a closer look at the specific factors that will mold software buyers over the next 12 months.

Without further ado, here are the five key factors shaping the modern software buyer:

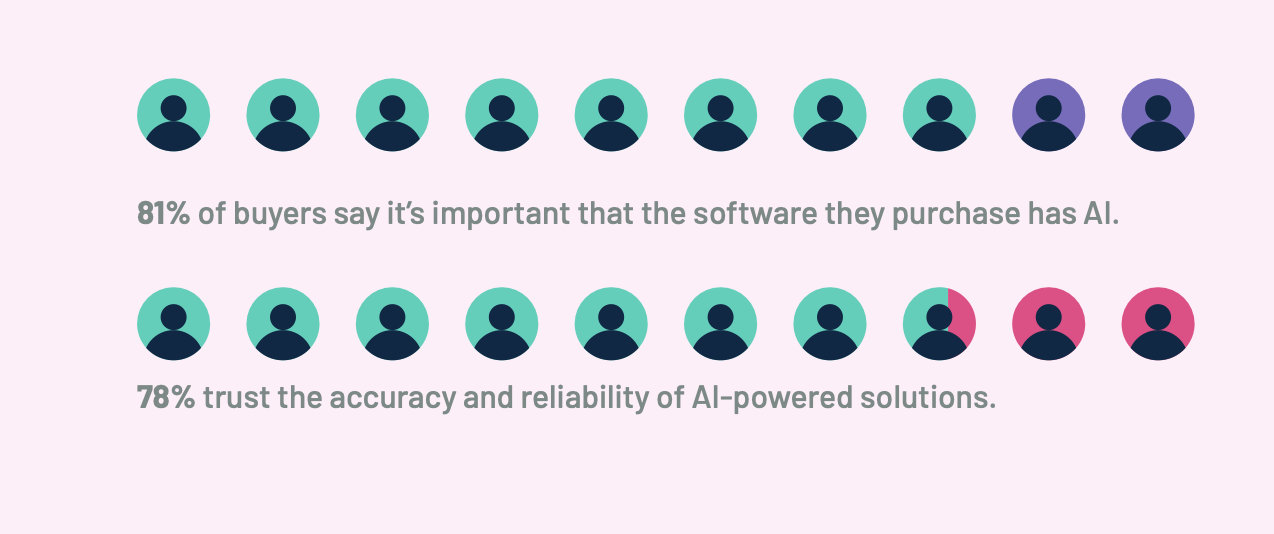

- Buyers see AI as foundational to business strategy.

The hype around generative AI has spurred a very real frenzy of businesses looking to secure a competitive advantage. In fact, 81% of respondents say that it is important that the software they purchase moving forward has AI functionality. What’s more, is that buyers today actually trust AI-powered solutions (78% trust or trust strongly the accuracy and reliability of AI-powered solutions). This level of trust paired with the fact that companies are willing to spend on AI despite economic uncertainty (59% of AI buyers anticipate spending in 2024 will increase) creates a perfect storm for businesses looking to inform future business strategy.

- AI will drive legal teams to be increasingly involved in software purchases.

One of the downstream impacts of the AI frenzy is the increasingly prominent role of legal teams in software purchases to protect company data and reduce potential risk in using AI-powered solutions. Most respondents (84%) indicate their IT department is responsible for conducting security or privacy assessments when evaluating software, but 40% say their legal department is involved — shooting up to 55% in EMEA countries due to its strict digital regulations. Expect legal’s role to spike in 2023 and beyond.

- Buyers stick to processes – but still succumb to the pressure to deliver results.

Over 80% of survey respondents said that they have an official buying process in place for purchasing software, yet business pressures still steer changes in behavior. Of those who said they have purchased shadow IT, buyers from mid-size (87%) and enterprise (93%) organizations did so because they needed to move quickly.

- Value, scalability, and ease are top considerations for software buyers, but priorities shift based on company size.

Small business buyers tend to prioritize ease of use and ease of implementation, while medium-sized and enterprise companies need solutions that will be able to keep up with their growth — with both ranking scalability as the third most important criteria. And due in part to current economic headwinds, buyers are prioritizing value over cost, regardless of size, scrutinizing every dollar spent.

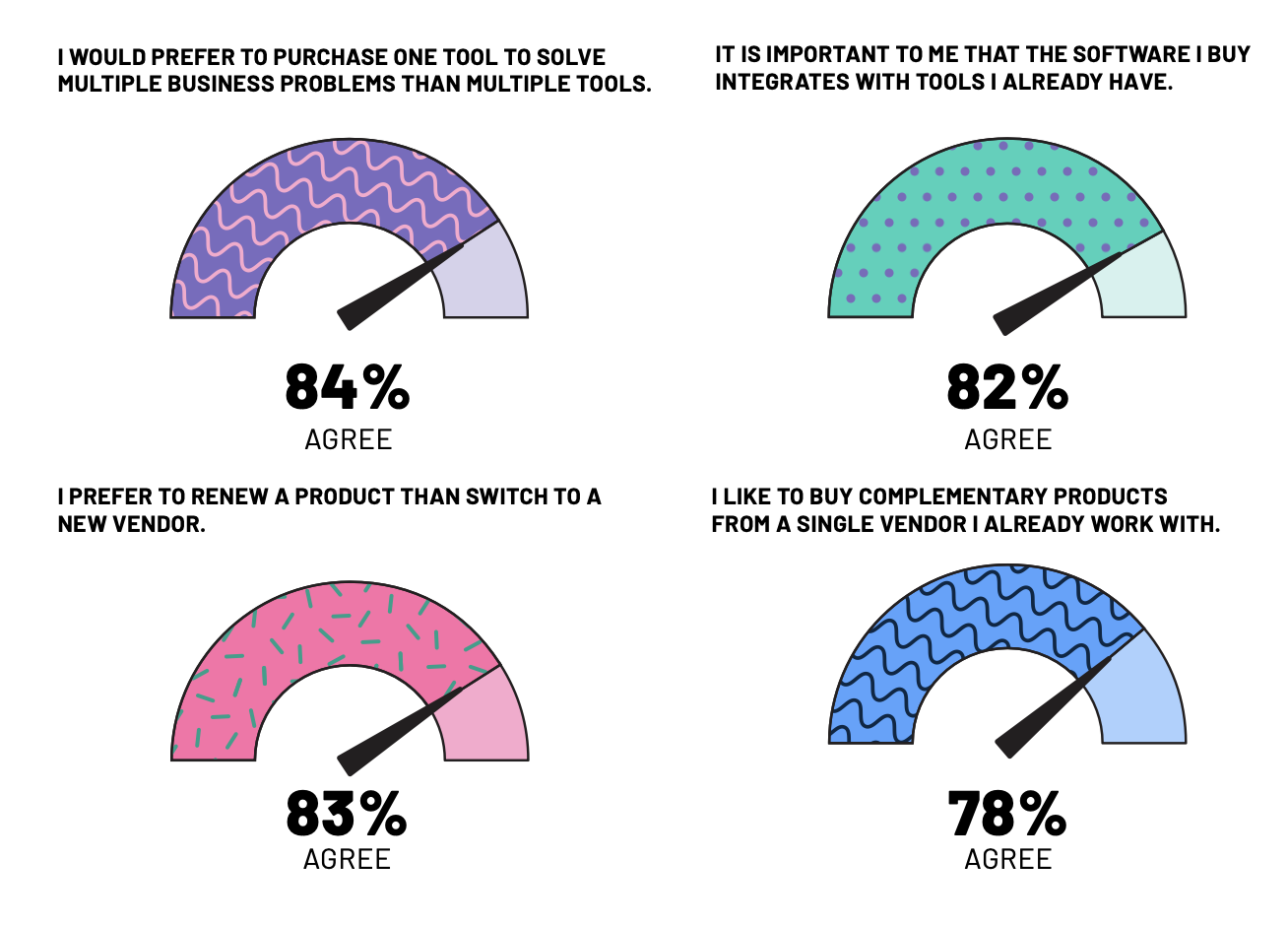

- Solutions to work together without added complexity are key.

Over 80% of respondents say it is important to them that the software they buy integrates with their existing solutions, ranking ease of integration even over the cost of the software. To avoid additional complexities, buyers also would rather work with fewer vendors and use a single solution vs. multiple tools. When it comes to products, the trend remains true:over half of buyers always conduct research and consider new alternatives, but 45% review without even considering new options.

Now that you have a taste of what factors are driving software buyers in 2023, I encourage you to dig deeper into this year’s report to find insights relevant specifically to your business. Visit our website to download the G2 2023 Software Buyer Behavior Report. There you can check out additional findings and read through the recommendations from our Market Research team to find out how to win, serve, and retain customers in the upcoming year.

by Chris Voce

by Chris Voce

by Chris Voce

by Chris Voce

by Chris Voce

by Chris Voce