It’s no longer a question today if software is essential to business success. We’ve all reaped the benefits and seen the positive impact on productivity, workplace culture, and revenue. What does remain a question, however, is what the essential tech stack looks like. There are over 145,000 different software products and services on G2 – so, how can a business know what should make it into its stack, or not?

To uncover the answer, look no further than "The Essential Tech Stack: The top tools powering modern-day software companies." The new report, released today by ICONIQ Growth in partnership with G2, provides an overview of the essential technology stack for software companies, helping them make informed decisions when choosing the tools and platforms needed to support four key areas: product development, data management and security, go-to-market, and internal operations. It also highlights some of the most essential categories and tools used by software companies today.

In addition to summarizing engineering data collected from a survey completed by ICONIQ Growth portfolio companies in September 2022, the report also gleans insights from proprietary review data on G2, the world’s largest software marketplace – reaching 80 million software buyers annually and featuring more than 2 million verified user reviews. Specifically, the report taps G2 review data from 2019-2022, including: Star rating, Net Promoter Score (NPS), Ease of use & Ease of setup scores, Top product features, as well as Qualitative feedback from users.

Three Trends About Software Stacks Informed by ICONIQ Growth & G2 Data

Informed by these data-driven sources, the new report reveals the following:

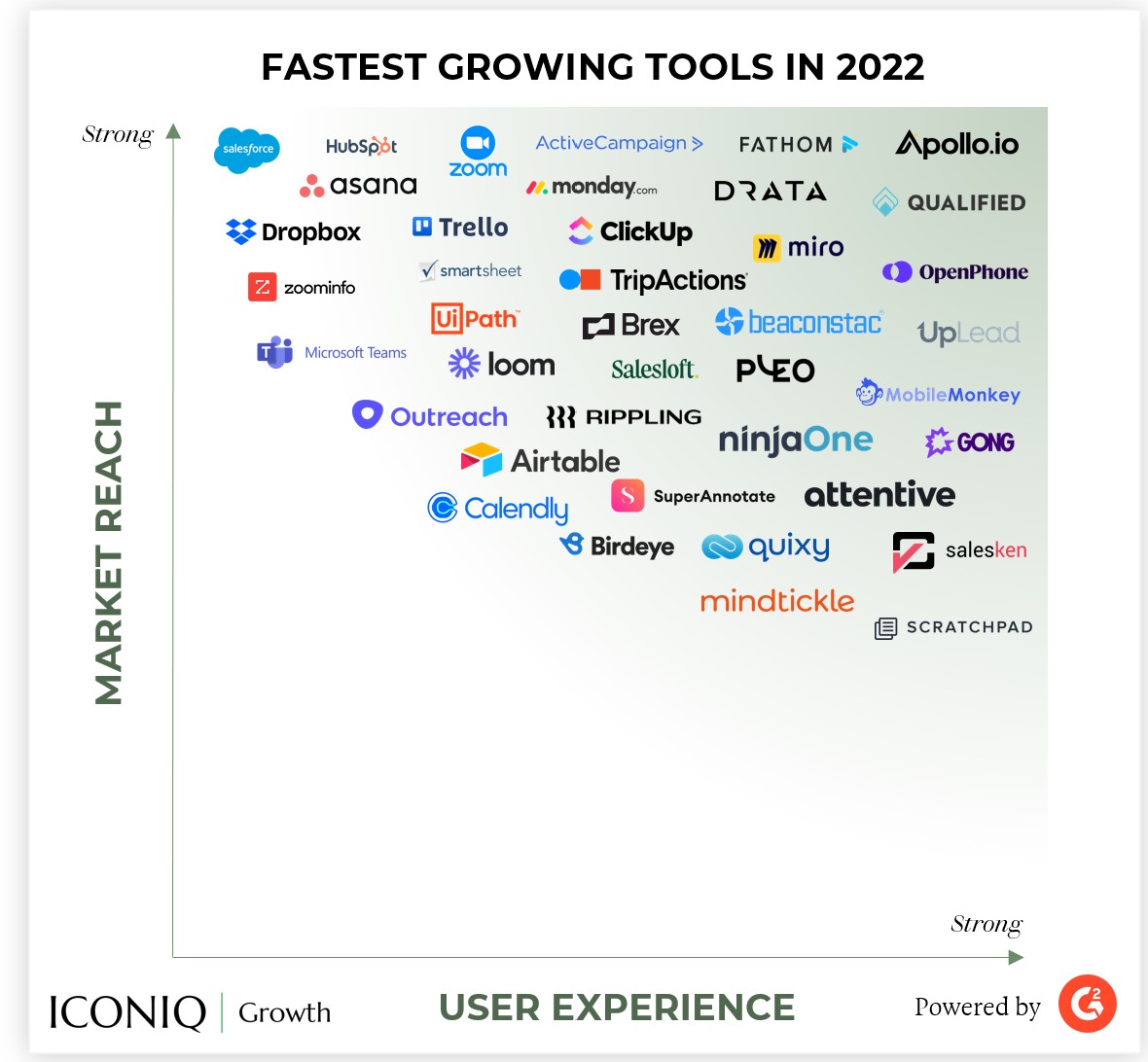

- Revenue Enablement & Collaboration tools dominated 2022. Based on market reach and review data from G2, ICONIQ Growth identified 40 tools that grew exceptionally well in 2022. Revenue Enablement and Collaboration tools came out on top, fueled by strong adoption from product-led growth motions and remote working tailwinds.

- Market reach does not necessarily translate to strong user experience. Despite gaining broad market reach, many tools have relatively low NPS scores. Notably, many of the fastest growing tools are product-led growth companies which require strong user experiences to enable bottom-up growth.

- User reviews showcase similarities among top tools. Across the four categories examined – product development, go-to-market, data/security, and internal operations – some common qualities mentioned in reviews that were shared by top tools include:

- Ease of use and implementation

- Strong integration with supporting products

- Immediate or near immediate ROI

- Strong support team

- Continual product enhancements

Top Software Tools Across 17 Key Categories

With ICONIQ Growth’s survey insights coupled with G2 review data, the report also identifies top tools and trends among a number of software categories. The top three tools noted in each category include:

- DevOps: GitHub, GitLab, Jenkins

- Incident Management: PagerDuty, Zendesk, Opsgenie

- BI / Analytics: Looker, Tableau, Amplitude

- Project/Workflow Management: Jira, Confluence, Aha!

- Data Warehouse / Storage / Recovery: Snowflake, Segment, Splunk

- Security: Crowdstrike, Palo Alto, Okta

- Machine Learning / AI: AWS, Domino, Google Cloud

- Application Monitoring: Sentry, DataDog, New Relic

- CRM & Engagement: Salesforce, HubSpot, Braze

- Sales Operations: Highspot, Outreach, Clari

- Marketing Automation: Marketo, HubSpot, 6sense

- Collaboration / Communication: Slack, Zoom, Google Workspace

- Payment Processing: Stripe, Plaid, Adyen

- Finance & Accounting: Oracle Netsuite, Expensify, Carta

- Content Management: AWS, Cloudflare, Fastly

- HR Tech: Workday, Lattice, Greenhouse

- Workflow Automation: Retool, Workato, Apache Airflow

The Essential Tech Stack will Vary Per Company, But it Must Be Resilient

We of course recognize that specific needs of a tech stack will vary, based on factors like a company’s scale and business priorities. The full report takes these considerations into account. One finding ICONIQ Growth observed, for example, is that as companies scale past $100M in ARR, there is a significant increase in spend in certain software categories like CRM, content management, collaboration, and application monitoring.

One thing we can expect all 2023 tech stacks to have in common though, is that they’ll be focused on building digital resilience – as businesses prepare for a looming economic recession, optimizing costs while remaining competitive. To learn more about how you can optimize your tech stack and embrace resilience in the year ahead, download the complete ICONIQ Growth report.

by Palmer Houchins

by Palmer Houchins

by Anna Charity

by Anna Charity

by Palmer Houchins

by Palmer Houchins