Late last year, we launched a new research series from G2: the State of Software. This research showcases real data and insights from the G2 marketplace. With over 160,000 product profiles, 2.5 million verified user reviews, and 90 million annual visitors, G2 has unique insight into the indicators that help better understand the state of B2B software.

Examining the key indicators of B2B software

Just as we look at indicators to understand the state of the economy, this research examines key indicators to understand the state of software. This second edition of the State of Software broadens the G2 datasets used in our analysis and zeroes in on key indicators from 2023. It includes: AI buyer sentiment and review theme analysis, software growth, G2’s proprietary Momentum scores, buyer traffic, and buyer ROI.

Key findings on the State of Software

On behalf of G2’s Market Research team, we’re excited to share the latest G2 State of Software report. According to our May 2024 edition, here are five key findings we observed:

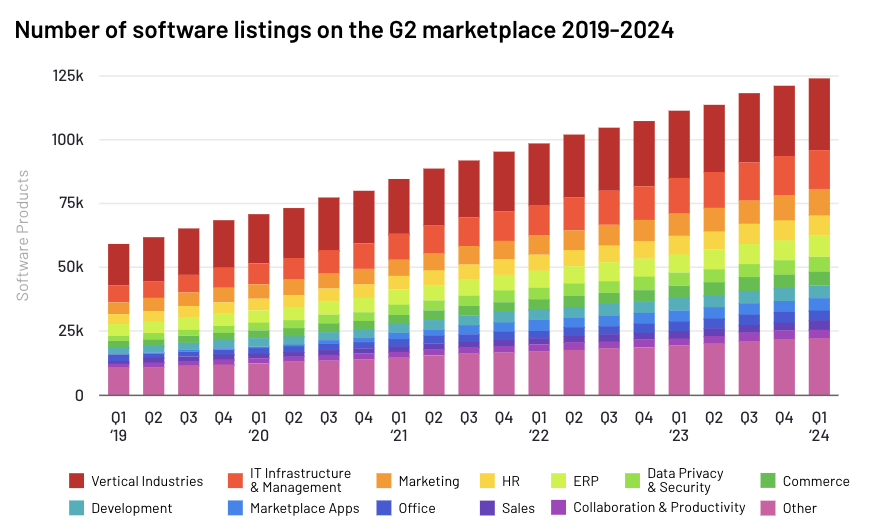

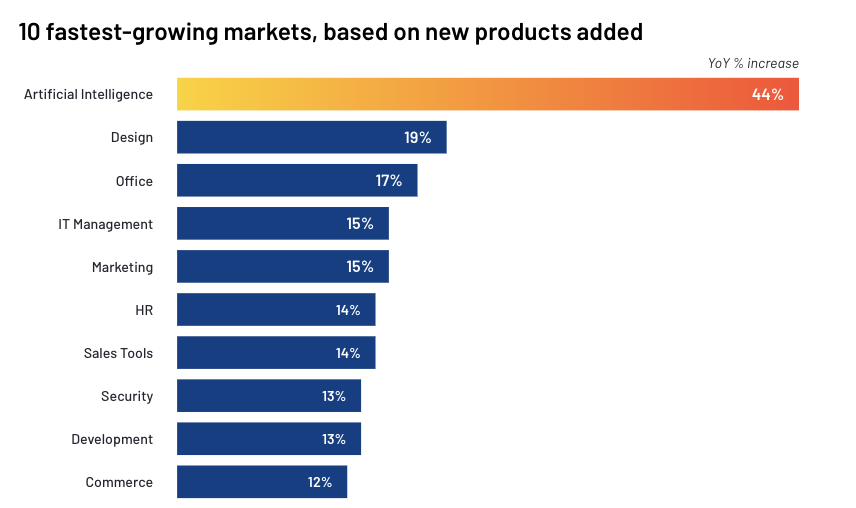

- G2’s marketplace grew more than 12% in 2023, fueled by AI. More than 19,000 new products were added. In October 2023, we revealed an average rate of 7% growth over the past five years, underscoring how rapidly the landscape has evolved in just the last year. Notably, core AI software led all markets on G2 in new product growth – experiencing a 44% year over year increase based on new products added. This is more than double the growth of the next fastest-growing category (Design, which is followed by Office software).

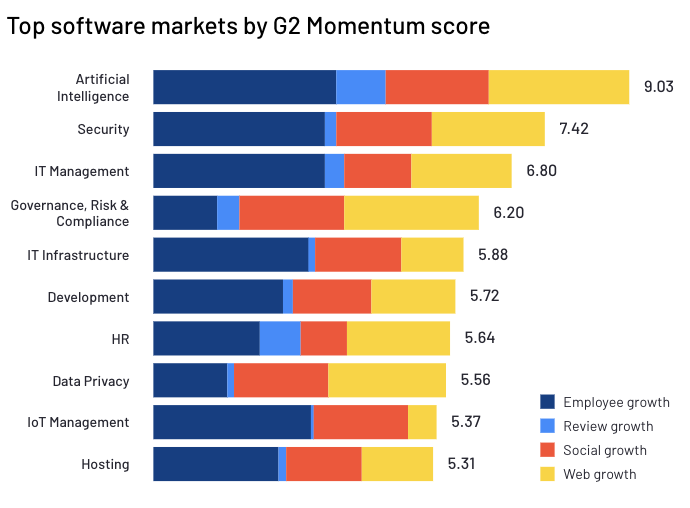

- AI & Security topped software markets for G2 Momentum scores. G2's proprietary Momentum score identifies categories that are on a high-growth trajectory based on YoY growth in user satisfaction scores, employee growth, and digital presence. It’s our measure of which software products are hot and trending. AI led all software markets in Momentum, reflecting the AI industry’s staggering growth in 2023. Security, IT Management, Governance, Risk & Compliance, and IT Infrastructure rounded out the top five.

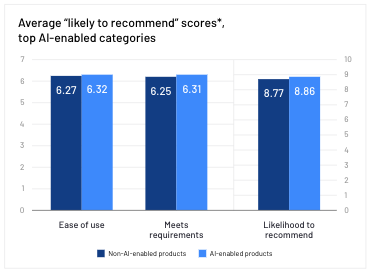

- AI isn’t moving the needle on satisfaction - yet. Last August, G2 started asking reviewers about the AI capabilities of products in nearly 200 different software categories to understand sentiment and satisfaction with AI features of software across the entire G2 taxonomy. Through these insights, we found that AI-enabled products in top AI-enabled categories scored only slightly higher with users on a number of metrics: ease of use, meets requirements, and likelihood to recommend. Given the newness of these generative AI capabilities, we’re not surprised. It will take time for customers to widely adopt solutions with AI capabilities and see their impact.

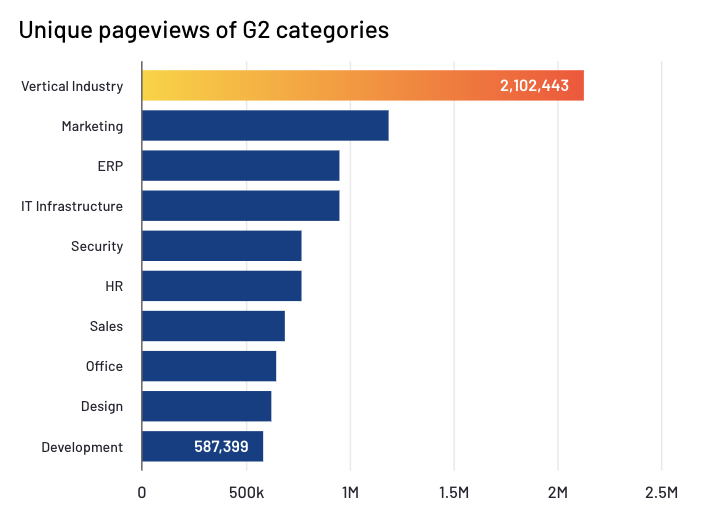

- Of the 90M buyers shopping on G2, 2M+ searched for Vertical market software. When looking at the unique pageviews of G2 categories over the past year, Vertical Industry software received the highest cumulative traffic – as critical sectors like healthcare, education, government, and nonprofit require specialized solutions to meet their unique needs. Marketing and ERP followed suit as the second and third most visited categories.

- More than two-thirds of buyers reported ROI in less than a year, with those using Design software experiencing the swiftest time to ROI. The pressure is on software vendors to show fast ROI, so we explored where this is easier and more difficult to achieve across the software landscape. Examining data across all of G2’s 2,100+ categories, we aimed to understand where buyers are finding the most value today. While less than half (44%) of buyers on G2 shared they have experienced ROI in less than 6 months, most have within a year. Digging deeper, the three categories that experienced the fastest time to ROI are: Design, Hosting, and Commerce – compared to the three slowest to ROI: HR, Supply Chain & Logistics, and Governance, Risk, and Compliance.

Explore our latest report insights & share your feedback

We hope our Software Software report provides a perspective into not just where B2B software is today, but where it’s heading next to position your organization for continued growth. While we highlighted some of the key findings above, there’s a lot more to dig into here – including additional analyst commentary around these findings and deeper drill downs into category and product insights.

Stay tuned for future editions and please let us know what you liked from this report or would like to see in the future by emailing research@g2.com.

by Chris Voce

by Chris Voce

by Shaun Bishop

by Shaun Bishop

by Godard Abel

by Godard Abel