It would be quite the understatement to say that the global economy has had its ups and downs the last couple of years. You might get whiplash if you try following along the ebbs and flows from January 2020 through today — timed with the COVID-19 pandemic, following IPO frenzy, and the more recent recession fears and layoffs.

In its Go-to-Market Economic Impact Study, launched today, GTM Partners examines key trends during this tumultuous timeline. Fueled by insights from G2, Demandwell, and Bombora, the study dives into what these findings mean for business performance today, how GTM teams are responding, and how to navigate efficient growth going forward.

G2 Buyer Intent data plays a key role in identifying market trends within the study, serving up insights on traffic to specific software categories on G2 from in-market buyers. Let’s dive in.

According to G2 Buyer Intent traffic, GTM Partners’ Go-to-Market Economic Impact Study finds:

-

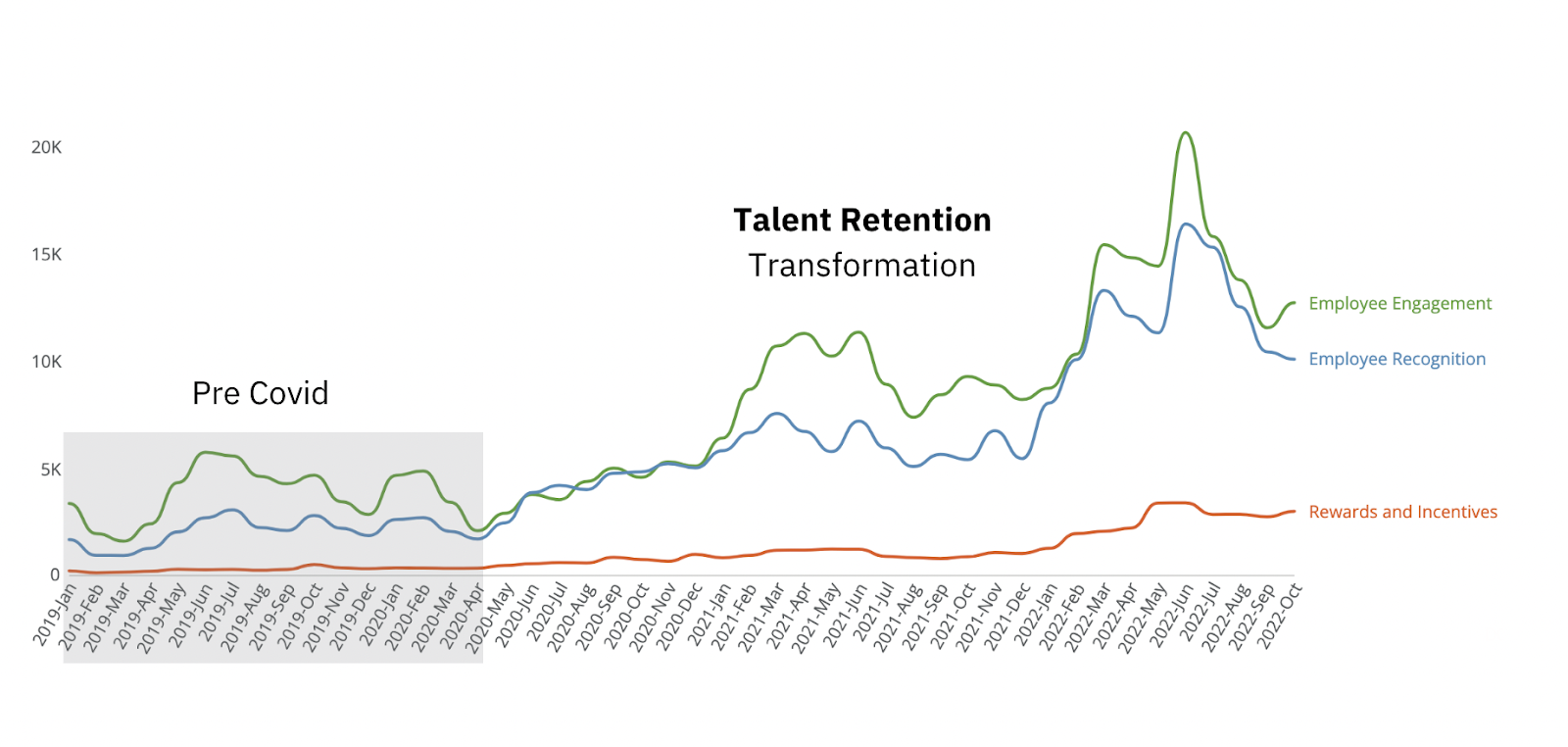

Talent retention has become a top priority for leadership teams. Buyer Intent traffic on G2 indicates that demand for software focused on talent retention (e.g., categories for Employee Engagement, Employee Recognition, and Rewards & Incentives) is up since the start of COVID-19, and even more so this year amid economic uncertainty.

-

Buyer demand for industry specific tech is down over the last six months, looking at industries including Transportation, Oil & Gas, Automotive, Healthcare, Travel & Expense, Financial Services, Hospitality, Supply Chain & Logistics, Business Services, and Education. It’s worth noting that despite this recent dip, G2 Buyer Intent traffic to these software categories is still higher when observing this year-over-year.

-

Businesses search for technology to improve GTM in a downturn. According to G2 Buyer Intent traffic for software departments, we see that Marketing leads the technology transformation. HR and Sales teams are second most innovative, while Customer teams still lag in the adoption of technology to improve outcomes.

-

Email Marketing and SEO are the top two post-COVID GTM channels. Buyers seek tried, trusted, and true channels that help them build pipeline efficiently. While it’s not surprising to see Email Marketing and SEO remain at the top, GTM Partners observed a growth in G2 Buyer Intent traffic to event-led channels too, including those like Virtual Event Platforms, Video Hosting, and Video Communication (more on this next…).

-

“Event-led’ emerges as a new type of GTM. Following March 2020, a rise in G2 Buyer Intent traffic is observed for event software — including categories for Virtual Event Platforms, Event Management Platforms, Live Stream, Event Registration & Ticketing, Webinar, Mobile Event Apps, and Event Marketing. GTM Partner considers “event-led” to consist of premium event experiences driving quality connections that include targeted educational roadshow events, as well as in-person, virtual, and hybrid events.

-

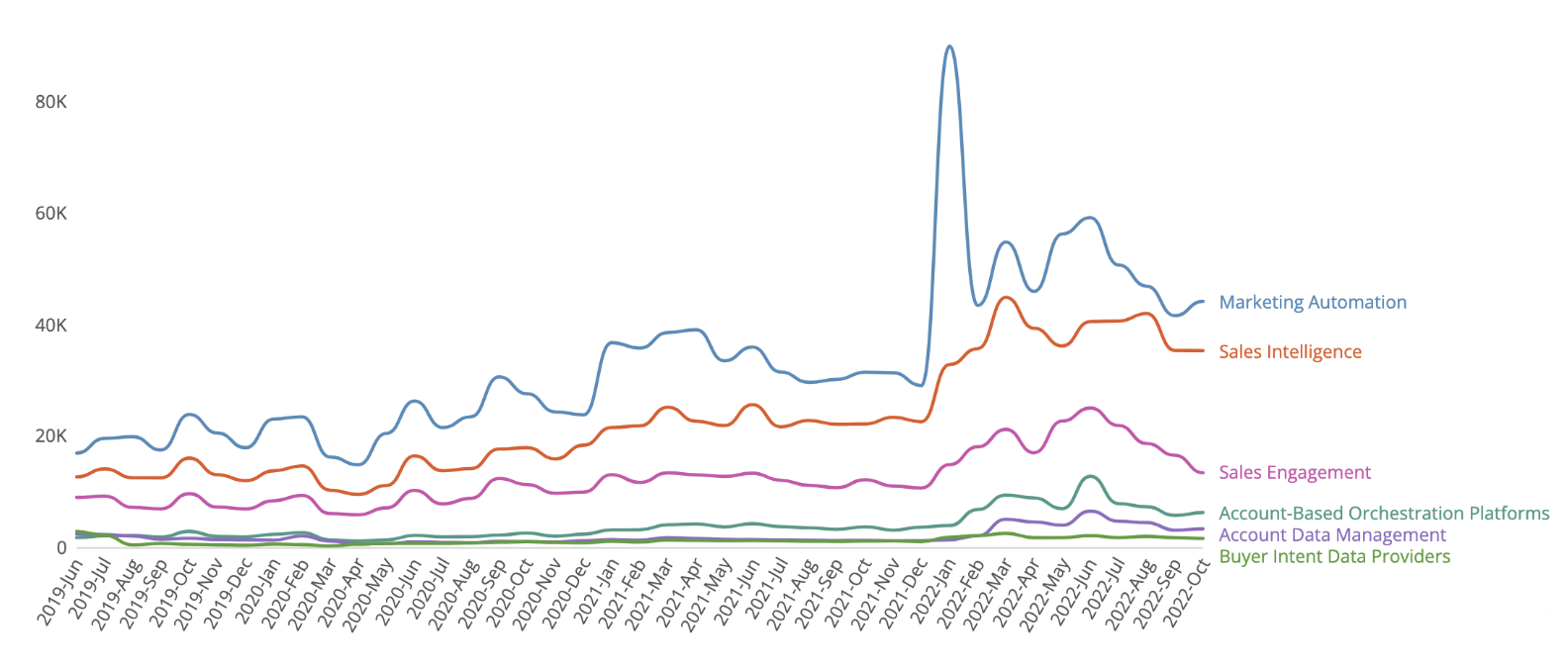

GTM teams are achieving efficient growth with tech enabled orchestration, as G2 Buyer Intent traffic continues to increase for Marketing Automation, Sales Intelligence, Sales Engagement, and other related categories. With tools like these, GTM Partners says teams are able to market and sell to ideal customers, beat competition with market intelligence, and more.

We know that B2B buyers' needs can be a moving target, as they constantly adapt to the evolving economic climate. This latest study from GTM Partners underscores the importance of keeping a pulse on your buyers. And in G2’s 2022 Software Buyer Behavior Report, we too, observed evolving preferences.

On December 8, I’ll be discussing this timely, important topic of software buyer behavior trends — joining leaders from GTM Partners, Bombora, and Demandwell to cover the GTM Economic Impact Study’s key takeaways. These include:

- Have a clear ROI of your product story to retain and expand your current customer base

- NRR is your single most important metric to focus on

- Growth at all cost mentality has shifted to efficient growth at scale

- Experimenting with your GTM plays is more important than ever with different motions like – Inbound, Outbound, Ecosystem, PLG, Event, and Category

- Companies that double down on sales and marketing to build brand and demand for the future will come out thriving in 2023 and beyond

To learn more, register for the GTM Economic Impact Webinar and download the full study.

by Laura Horton

by Laura Horton

by Jenny Gardynski

by Jenny Gardynski

by Laura Horton

by Laura Horton