We recently launched the 2024 G2 Buyer Behavior Report, based on an annual survey of more than 1,900 B2B software buyers across the globe. As the VP and General Manager of EMEA at G2, I was curious how respondents in the region responded — to understand any nuances in their plans, behaviors, and attitudes.

So, what did EMEA software buyers have to say? Let’s dive in.

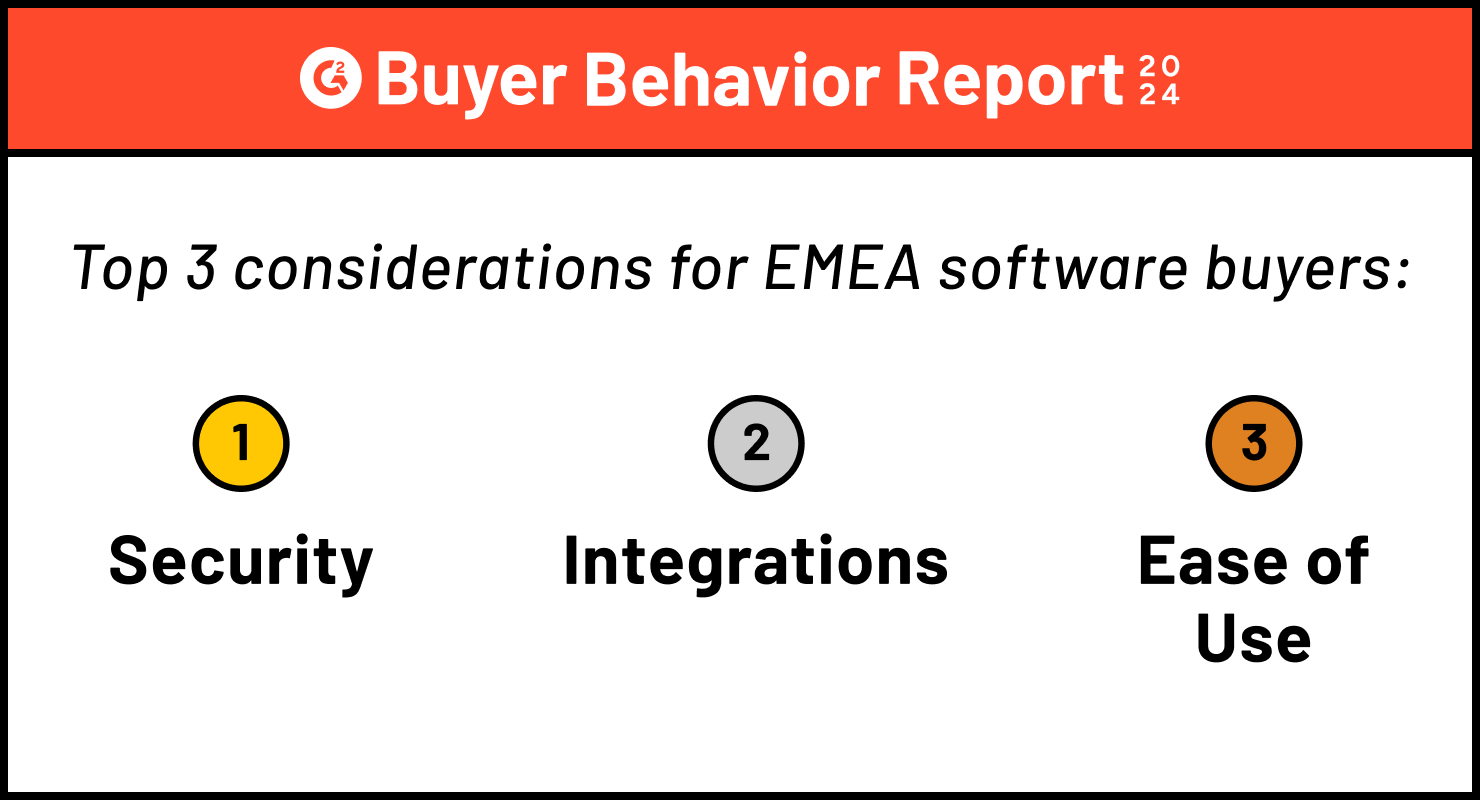

Security, integration, & ease of use top buying considerations

When asked about their top considerations for buying software, EMEA respondents reported the following as their top three:

- Security features the software provides

- That the tool easily integrates with other software we already use

- How easy the tool is to use

As security breaches continue to make headlines and security stakeholders take on a larger role in the software buying process, we are seeing more security-conscious buyers. With this in mind, vendors have an opportunity to tout their certifications and communicate their commitment to minimizing security risks for customers. And as integration continues to be a crucial part of buying decisions, vendors should maximize their integration partnerships and highlight those in their marketing and sales outreach efforts.

C-suite leads decision-making, while legal is a blocker

Two trends we saw across all respondents was the rising role of the C-suite as the ultimate approver for software purchases, while legal presents a barrier to purchase. Both of these trends ring even truer among EMEA software buyers.

When asked “At your company, who is ultimately responsible for making a software purchase decision?,” nearly a quarter (24%) answered “C-suite (non-CFO)” compared to 20% of those in APAC and the same amount in North America. Additionally, 64% of EMEA respondents said the legal team always/frequently slows or blocks their purchases, compared to 62% in APAC and 59% in North America.

Recognizing these pressures buyers face today, software vendors should ensure they have messaging that caters to these crucial executive and legal personas to help streamline the process and make a ‘yes’ decision easier to make.

Service provider search commences in software research phase

We also saw service providers playing an increasingly pertinent role in the software buying journey. One regional nuance we spotted is that while North American and APAC buyers are more likely to start considering service providers/implementers during the Discovery phase, EMEA buyers (48%) are more likely to do this during Research – compared to APAC (35%) and North American (33%) buyers.

As service providers can impact a software buying decision – and they’re being considered earlier in the journey – vendors should highlight these providers early and often, emphasizing success stories from prior implementations.

EMEA buyers turn to trusted peers and third-party marketplaces

The role of trust in software buying cannot be overstated. Just as we turn to reviews or word of mouth from peers before booking a hotel stay, a restaurant reservation, or purchasing a pair of shoes – we do the same in our professional lives when purchasing software. This is perhaps why “professional colleagues/professional network” was the #1 most influential source in the purchasing process for EMEA buyers. This ranks above other sources like salesperson, vendor supplied content, and industry experts.

Additionally, purchasing software from third-party marketplaces is a stronger trend in EMEA than other regions. More than 4 in 10 (43%) EMEA respondents said they most commonly purchase software for their business from this source, compared to 27% of North Americans and 22% of those in APAC – signifying a shift away from engaging vendor salespeople directly.

Vendor salespeople still have an important role to play, but they should ensure they show up and can be helpful wherever buyers are searching during their self-serve journey – from review sites, to communities, to marketplaces.

Read more global insights on the state of software buying

To read the full report, featuring insights from software buyers across the globe, download the complete 2024 G2 Buyer Behavior Report.

by Gordon Tobin

by Gordon Tobin

by Chris Perrine

by Chris Perrine

by Chris Perrine

by Chris Perrine