The consumerization of B2B software buying continues to proliferate. I’ve observed this myself over the years, but it’s nice to have some validation from real software buyers. Our annual Buyer Behavior Report, based on responses from 1,900+ buyers across the world, has emphasized this growing trend.

As G2’s VP of Asia Pacific, when the results of our latest edition arrived – 2024 G2 Buyer Behavior Report – I was most interested to learn how buyers in the region are discovering, researching, and purchasing software today.

When asked about their top considerations for buying software, APAC respondents reported their top three as:

- The tool easily integrates with other software we already use

- Security features the software provides

- Scalability - ability for software to support my team/company as it grows

These are crucial factors software vendors should keep in mind as they look to drive growth and retention in the APAC region. Let’s dive into some additional findings to learn what’s on buyers minds in 2024.

APAC buyers most optimistic on tech & software spending

Among all respondents, those in APAC were more optimistic about expanding their spending. More than half (57%) of APAC buyers anticipate their company’s software and tech spend will increase in 2024 compared to 2023 – versus 36% of EMEA buyers and 42% of North American buyers who said the same. And when it comes to looking further ahead to 2025, APAC buyers are even more bullish. 67% forecast a budget increase compared to 2024, versus 45% in EMEA and 49% in North America.

While buyers do have dollars to spend, they’re placing extra scrutiny on their software investments. Vendors will need to take steps to stand out from the competition and engage in-market buyers if they want to capture some of that budget.

The rise of the security conscious buyer

APAC buyers (91%) say their organization requires a security or privacy assessment when purchasing software more often than their EMEA (76%) and North American (78%) counterparts. Similarly, buyers in the region also consider a vendor’s history with breaches or security incidents when evaluating software – 91% compared to 75% of EMEA and 80% of North American respondents.

For software vendors, be sure to tout your security standards and certifications to ease buyers’ concerns. Recognizing the crucial role security plays in the deal cycle, G2 recently rolled out the first security section to G2 Profiles, where software sellers can seamlessly share their security posture with buyers directly from G2.

IT & Information Security teams are crucial to decision-making

While IT and Information Security play a role in software buying decisions around the globe, their role is even more prominent in APAC. According to our survey, IT and Information Security play a role for 69% and 55% of APAC respondents, respectively – compared to smaller percentages in EMEA (41%, 41%) and North America (51%, 40%).

Despite the C-suite/financial leaders having an ultimate approval on most buying decisions, vendors must recognize the various departments that contribute – including IT and Information Security (especially given the increasing focus on security). Be sure to have custom messaging catering to each persona, speaking to their unique needs and concerns.

High levels of trust, usage, + high expectations for AI

AI is disrupting the way software is bought and old as we know it. There’s been a flurry of new vendors, products, and features. But is it all hype? According to our report, no. Software buyers across the globe are trusting and turning to AI solutions. It’s what’s fueling their spend, but they have high expectations for ROI on these solutions – especially for amping up employee productivity.

This trend is even more pronounced among APAC buyers:

- 77% say they trust the accuracy and reliability of AI-powered software solutions - vs. 66% of those both in EMEA and North America

- 87% believe software companies have genuinely advanced AI technology in their products, beyond merely capitalizing on the AI hype – vs. 73% in EMEA and 74% in North America

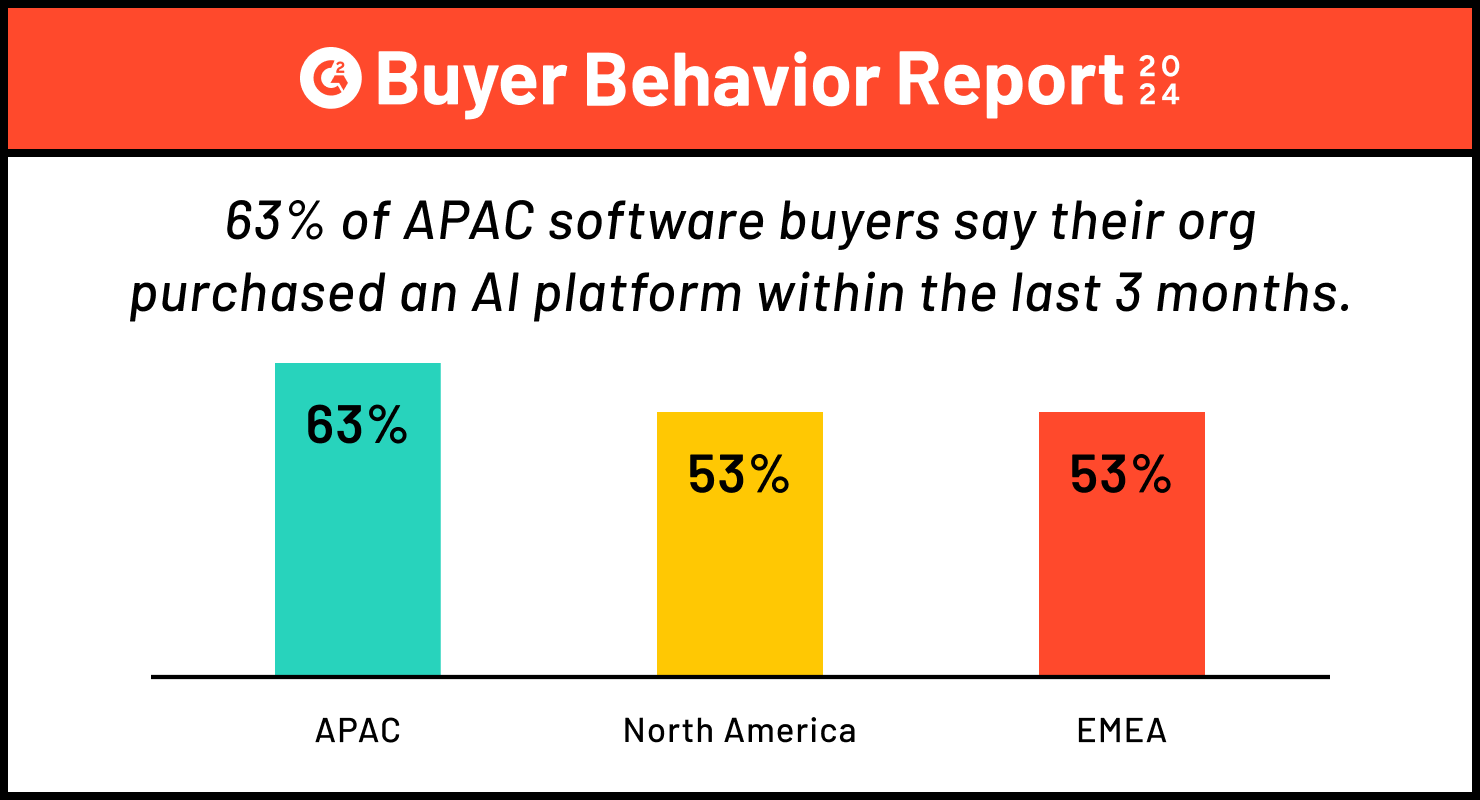

- 63% say their organization has purchased an AI platform in the past 3 months - vs. 53% in both EMEA and North America

- 84% report their organizations encourages them to use AI in their role - vs. 73% in EMEA and 67% in North America

- 76% expect to achieve ROI from its AI/AI-powered software faster than other software investments – vs. 53% in EMEA and 61% in North America who shared this sentiment

Showcasing AI features and functions will be key for software vendors to meet modern buyers’ needs, but it must deliver measurable ROI, quickly.

Read more global insights on the state of software buying

Wrapping up, what we’ve continued to see through our annual Buyer Behavior reports is that APAC increasingly is no longer following the technology trends which historically have been set in North America and EMEA. In many ways, APAC is now leading in the adoption of new technologies and trends and forward thinking companies are using technology as a key enable to compete locally and globally.

To read the full report, featuring insights from software buyers across the globe, download the complete 2024 G2 Buyer Behavior Report.

by Chris Perrine

by Chris Perrine

by Paul Gilhooly

by Paul Gilhooly

by Gordon Tobin

by Gordon Tobin