At G2, we recently released our 2023 Software Buyer Behavior Report. The report highlights key trends, based on responses of 1,700+ B2B software decision makers — including the five factors shaping software buyers over the next 12 months.

While this is a global representation of software buying behavior based on a survey of respondents in North America, EMEA, and Asia Pacific, there are of course nuances in those behaviors within each region. In this piece, I’m taking a deeper look at some of the notable trends of EMEA software buyers in particular.

What matters most in software buying & renewals to EMEA software buyers

First, let’s take a look at what matters most to EMEA software buyers during the software buying process. When making purchasing decision, their top three considerations are:

- How easy the tool is to implement

- That I will receive ROI in 6 months

- That I will receive ROI in 1 year

However, priorities shift when making a software product renewal decision. For EMEA respondents, the top three pieces of information they look at to determine whether to renew or not are:

- How well users like the product

- How critical the product is for the user’s role

- How frequently the product is being used

Buying committee has many players, but C-suite, Legal, and Finance carry more power in EMEA than other regions

The C-suite is most likely to have ultimate responsibility for a software purchase decision in EMEA, with this group ranking higher in EMEA (39%) compared to North America (28%) and APAC buyers (26%). Despite the C-suite being most likely to have ultimate decision-making power in EMEA software buying, they’re not the only influential voice.

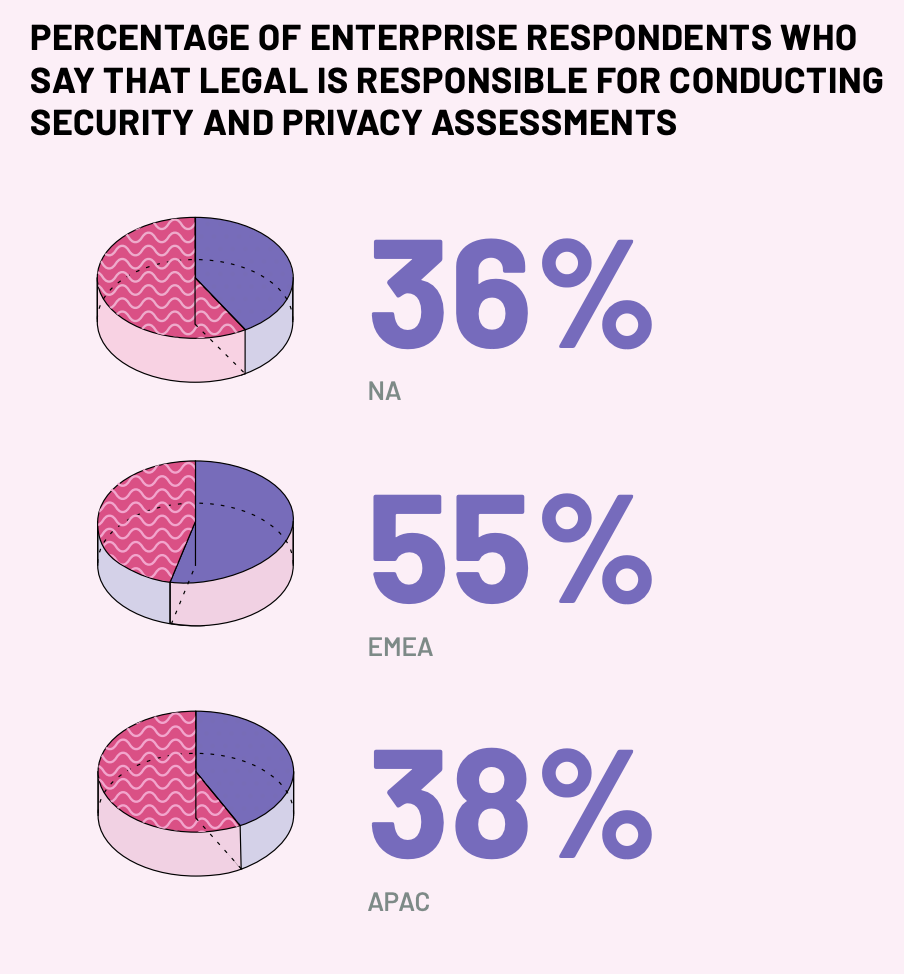

For example, Finance is more likely to be involved in software purchasing decisions in EMEA (53%) than North America (41%) and APAC (40%). Additionally, while 40% of global respondents indicated their Legal department is involved in conducting security or privacy assessments when evaluating software, this shoots up to 55% in EMEA countries due to more stringent digital regulations in the region.

EMEA buyers have stronger preference to purchase software via credit cards and from third-party marketplaces compared to North American and APAC buyers

Beyond who is involved in the buying decision, other trends were also observed among EMEA buying, such as how and where they’re purchasing software. Notably, EMEA software buyers (49%) have a stronger preference to purchase software on a credit card compared to their North American (43%) and APAC (46%) counterparts – as opposed to an invoice/purchase order payment method.

Additionally, EMEA software buyers have a stronger preference to purchase software from third-party marketplaces than North American and APAC buyers. Specifically, 30% of EMEA respondents said they prefer to purchase software from a third-party marketplace – as opposed to directly from a vendor or from a value-added reseller), compared to 24% of North American respondents and 21% APAC buyers surveyed.

Takeaways for EMEA software vendors

With these survey findings in mind, here are four takeaways for EMEA software vendors:

- Lead with a richer view of value. Considering EMEA buyers’ priority to drive ROI quickly – within 6 months to a year of purchasing a solution, it’s crucial to lead with a solution’s value. Simple ROI calculations fail to capture the full impact of a solution’s potential on a customer’s environment. As vendors increasingly employ business value advisory consultants to learn about and advise on how solutions create business value over time, vendors should embrace more complete assessments that include bottomline cost savings or risk mitigation, topline business growth examples, and strategic growth opportunities.

- Optimize post-purchase stages. To drive that necessary, fast ROI, software solutions need to be implemented effectively and quickly. Users also need to be maximizing their usage of the solutions. To ensure this, there is an opportunity for software vendors to optimize the post-purchase stages including implementation and training. Customer service, support, and product marketing can play important roles in providing helpful resources, training, and communications. Not only will this contribute to the customer getting the most value from their tool to see the ROI, but it will also increase chances of a renewal.

- Cater messaging toward all stakeholders. As we observed in our report, there are various stakeholders in the software buying committee. In EMEA, the C-suite wields most decision-making power but Finance and Legal play stronger roles here than they do in other regions. Whether it’s prioritizing data privacy and security messaging for Legal, or ROI messaging for Finance, ensure you’re speaking to the pain points and priorities of any and all stakeholders involved.

- Diversify purchasing methods and channels. Even though EMEA buyers are more likely than those in other regions to purchase software on a credit card and via a third-party marketplace, we know that every buyer is unique with their own preferences. Therefore, consider the more modern approaches of EMEA buyers but also remember to meet your customers wherever they might be: vendor websites, social media groups, peer networks, review sites, marketplaces, etc. Provide options that will make it as easy as possible for them to purchase – whether that’s various contract lengths or paying via credit card or invoice. It’s about catering to your buyer, making things easier for them, and supporting them along their journey.

To learn more about the mindset of B2B buyers in 2023, you can download G2’s Software Buyer Behavior Report.

by Paul Gilhooly

by Paul Gilhooly

by Chris Perrine

by Chris Perrine

by Chris Perrine

by Chris Perrine